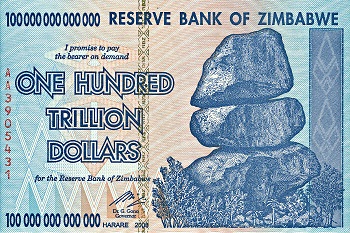

Demise of the Dollar: Rush to Gold is Here

Over the course of history, we have read about the rise and fall of empires and the transition from one era to another. Today, we see more of things like the dollar unfold before our very eyes. The Dollar Dollar, whenever mentioned, most often than not, the concepts supremacy, wealth, gold and the like are … Read more